Financial Scoring

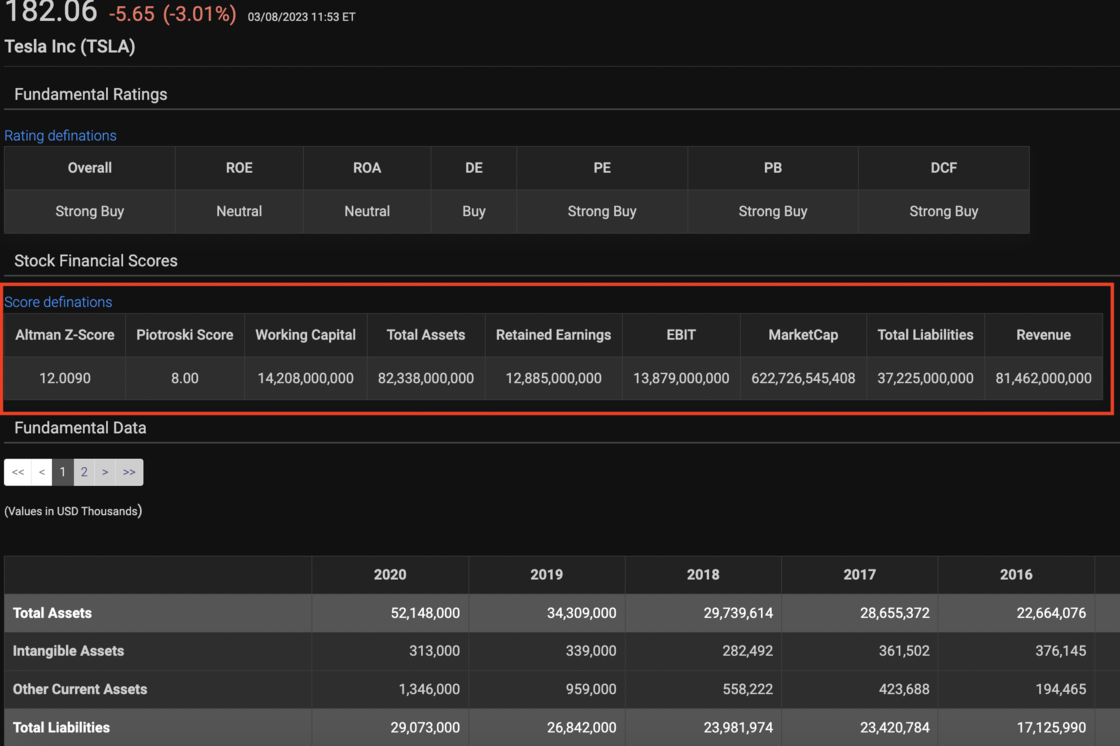

In our fundamental data coverage, we've enhanced our 'Fundamental' app to also display the following new financial scoring numbers along with key indicators i.e.

Following are the calculation for our stock scorings.

Altman Z-Score:

The Altman Z-score is calculated by using the following formula:

A = working_capital / total_assets

B = retained_earnings / total_assets

C = EBIT / total_assets

D = market_cap / total_liabilities

E = revenue / total_assets

Altman Z-Score = 1.2A + 1.4B + 3.3C + 0.6D + 1.0E

Piotroski Score:

The score consists of the following criteria (each rule assigning one point):

Profitability Criteria:

The Rules for this Criteria (4 points):

roa_ttm > 0: Score +1

net_income_ttm > 0: Score +1

operating_cashflow_ttm > 0: Score +1

operating_cashflow_ttm > net_income_ttm: Score +1

Leverage, Liquidity, and Source of Funds Criteria:

The Rules for this Criteria:

current_ratio_this_year > current_ratio_last_year: Score + 1

long_term_debt_this_year < long_term_debt_last_year: Score + 1

outstanding_shares_this_year < outstanding_shares_last_year: Score + 1

Operating Efficiency Criteria:

The Rules for this criteria:

gross_margin_quarter > gross_margin_last_year_quarter: Score +1

asset_turnover_ttm > asset_turnover_last_year: Score + 1

The Piotroski score is a discrete score between zero and nine that reflects nine criteria used to determine the strength of a firm's financial position.

To access: Search for any global symbol say TSLA, then from the symbol menu, select Financials > Fundamentals

Last updated